The deficit is not an economic problem—it’s a political weapon

Our politicians use the deficit as a rhetorical cudgel to keep their friends rich while pushing austerity on the rest of us

Photo courtesy the Bank of Canada/X

Mark Carney’s long-anticipated investment-austerity budget has finally been tabled before Parliament and it’s set to raise the deficit to $78 billion. While the details of the budget will be debated over the coming weeks, the big picture is that the prime minister delivered on his promises: expanded defence and infrastructure spending “offset” by more than $50 billion in cuts and other savings. For months Carney has been laying the groundwork for these moves, making high-profile statements about Canada’s supposed spending problem and promising to discipline government workers in order to restore fiscal sanity. This kind of deficit trolling was always meant to frame his regressive policies as the only ‘responsible’ course of action.

However, this budget makes it hard to take Carney’s concern over the deficit seriously. He remains committed to keeping tax loopholes open for billionaires and ensuring our nations’ rentiers get a free ride. After exacerbating the deficit with his own irresponsible tax policies earlier this year, Carney wants to use the very problem he helped create to justify vicious cuts to nearly every federal department and the sunsetting of programs Canadians rely on (health, environmental, and Indigenous services programs are all on the chopping block). In this context it’s hard to take his handwringing over operational spending as anything other than disingenuous.

Despite the obviously conservative nature of the budget, Conservative Party leader Pierre Poilievre has positioned himself to push back with some deficit trolling of his own. He has spent weeks angling for a second shot at an election, saying that his party may not support a budget with a projected deficit of over $42 billion. With the NDP also unlikely to vote in favour of the budget come November 17, it may be up to the Bloc Québécois to decide whether enough of their 18 demands have been met to push it through Parliament and keep Canadians from going back to the polls.

When the prime minister rolls his eyes at the Conservative’s cynical deficit talk in the coming days, we should remember that the Liberals are equally adept at leveraging deficits to further both their policy agenda and their political advantage.

Last winter, the Liberals staged an elaborate drama around the deficit. It began with Chrystia Freeland’s resignation from cabinet where she cited concerns that Trudeau was prioritizing “costly political gimmicks” ahead of “capital and investment.” Days later, the government announced a suddenly ballooned deficit, a $20 billion increase achieved not through new spending but by loading the books with future “contingent liabilities” such as anticipated payouts for upcoming Indigenous litigation and write-downs of pandemic-era lending. There was no fiduciary imperative to add these liabilities to the balance sheet, but there was a powerful political one. The manufactured crisis provided the pretext necessary to orchestrate Trudeau’s exit and launch a leadership race, allowing the party to rebrand itself as fiscally ‘responsible.’

In retrospect, the past year has been rife with high profile examples of politicians using deficits to manipulate the public. It’s tempting to believe that the performative panic of our politicos indicates some genuine issue with Canada’s finances, but the actual deficit is quite small in macroeconomic terms. Canada has reduced its deficit more rapidly than other OECD countries following the pandemic-related surge, and our debt-to-GDP ratio is below G7 averages and less than half of Japan’s. Canada’s net public debt is also the lowest in the G7.

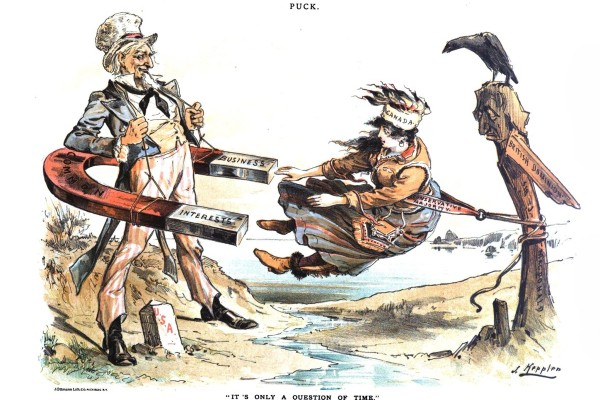

In global terms, Canada’s public debt is modest and far from alarming. We simply do not carry the kind of debt that can destabilize a national economy. The crippling liabilities that erode sovereignty and force nations into structural adjustment programs share two key features: they are held externally and they are denominated in a foreign currency the borrowing government does not control. Canada faces neither of these issues. The majority of our debt is debt we owe ourselves. Meanwhile, the debts we do owe to foreign investors are largely bonds denominated in Canadian dollars. As a monetarily sovereign nation that borrows almost exclusively in our own currency, the risk of involuntary default is negligible.

The federal government’s partnership with the Bank of Canada ensures this stability. The central bank not only sets interest rates but can also purchase federal bonds directly, providing a built-in buyer of last resort and ensuring that liquidity never becomes a constraint on public spending. This capacity distinguishes Canada from sub-sovereign governments—like provinces or Eurozone members—that truly can “run out of money.”

Any clear-eyed assessment of the risks posed by Canada’s financial situation indicates that deficits are just not the five-alarm fire they’re made out to be. Canada’s relatively minor deficits could be resolved tomorrow with realistic tax reform. By closing loopholes and instituting some basic fairness to the tax code this government could enjoy surpluses even with our economy under siege by Donald Trump. An “alternative budget” released by the Canadian Centre for Policy Alternatives shows that a rationalized tax system could add almost $100 billion a year to the federal budget.

Modern monetary theory (MMT) takes an even bolder position, arguing that deficits denominated in sovereign currencies pose no risk to national solvency. MMT posits that deficit spending becomes a problem only when the money it pushes into the economy increases demand for goods and labour beyond what the economy can physically support. When seen through this lens, deficit spending only becomes problematic when it leads to inflation. An MMT budget would have both operating and capital expenses financed through the Bank of Canada, which is exactly what it was set up to do. In fact, from the 1930s through the 1970s, the Bank of Canada routinely created credit for public investment—from the Trans-Canada Highway to postwar housing programs—without triggering runaway inflation or jeopardizing fiscal stability.

Whether or not you find MMT convincing, it is indisputable that Canada’s deficit is not a threat to economic stability. As a financial problem it is eminently solvable. However, as a rhetorical instrument it is quite dangerous. The deficit’s primary function is political: it is a cudgel used to enforce unpopular policies and coerce the public into accepting a diminished quality of life in the name of private profit. We must stop mistaking this political strategy for economic necessity.

James Hardwick is a writer and community advocate. He has over ten years experience serving adults experiencing poverty and houselessness with various NGOs across the country.