-

The myth of the immigrant threat

Anti-immigrant sentiment is surging in Canada, with politicians and far-right pundits blaming newcomers for crises in housing, health care, and unemployment. But these problems stem from policy failure and inequality, not immigration. Scapegoating immigrants diverts attention from the real causes and fuels racism at a time when solidarity is most needed.

-

The deficit is not an economic problem—it’s a political weapon

Mark Carney’s new budget exposes how Canada’s political class weaponizes the deficit to protect elites and justify austerity. Despite alarmist rhetoric, Canada’s debt is modest and self-financed. The real danger isn’t economic, it’s political: using deficit panic to erode public services and discipline workers in the name of “fiscal responsibility.”

-

The Regina Manifesto’s unfinished business: the case for public banking

Canada’s banks no longer serve the real economy. Decades of private lending have fuelled housing bubbles, record household debt, and economic instability. Revisiting the CCF’s Regina Manifesto, James Hardwick makes the case for public banking—a solution to redirect credit toward housing, infrastructure, and productive investment while reclaiming finance as a public utility.

-

A deficit paid by workers and a bailout for the wealthy

Canada’s deficit is projected to rise by $17 billion, yet ordinary Canadians face cuts to essential services while the ultra-wealthy and multinational corporations avoid billions in taxes. Closing loopholes and taxing hidden offshore wealth could fully fund health care, housing, and education—proving the crisis is a political choice, not an economic necessity.

-

Canada’s democratic deficit can no longer be ignored

It is difficult to imagine Carney’s Liberals collapsing as dramatically as the rudderless Starmer-led UK Labour government. That said, the rise of hard-edged, anti-system populism in Canada will be difficult to prevent unless the centre and left actively confront the deepening gaps in our democratic system before further economic turbulence intensifies the crisis.

-

Canadians are living through a people’s recession

The disconnect between big economic indicators and Canadians’ day-to-day experience is a gap our political leaders seem unable or unwilling to bridge. Indeed, parliamentarians have gotten in the habit of telling us that everything is basically fine—we just need to live within our means. It hasn’t occurred to them that the economic indicators might be missing something.

-

Canada needs an industrial strategy that serves public goods, not corporate interests

Diversifying Canada’s economic strategy is essential in an era of tariff escalation and growing geopolitical volatility. Stellantis’s recent announcement that it’s heading south sent another Arctic chill to concerns over Canada’s industrial future. Billions in public subsidies are flowing to foreign multinational automakers, yet questions remain: Who benefits?

-

The privatization crisis at Canada Post

Canada Post is under attack. Political favouritism, privatized delivery, and precarious subcontracting are putting workers and public service at risk. From Intelcom’s exploitative practices to the government’s support of billion-dollar profits, André Frappier discusses how one of Canada’s most essential institutions is being dismantled, and who is benefiting.

-

Canada’s debt time bomb

Canada’s household debt has soared to $3.07 trillion, the highest in the G7 for 15 years. James Hardwick explores how speculation, housing bubbles, and government policy created a fragile economy where ordinary families bear the costs—warning of bankruptcies, austerity, and the urgent need to confront financial elites.

-

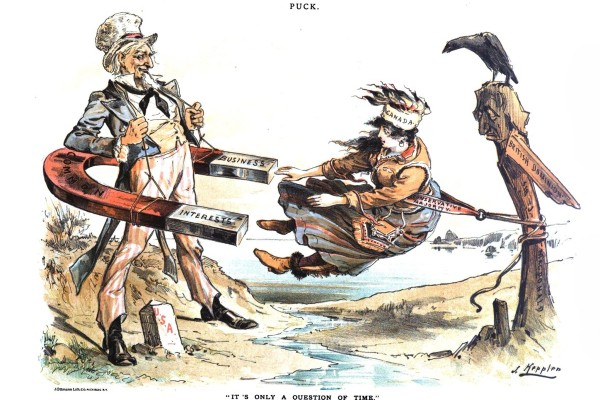

Progressive nationalism and the fight for Canadian sovereignty

The threat to Canadian sovereignty is real and it demands a renewed analysis and a third wave of progressive nationalism to meet the challenges of the post-globalization era of authoritarian US imperialism. The fight for Canada is the central political issue of our time and it will inevitably unite or divide Canadian labour and social movements.