What’s the use of the Pandora Papers?

Tax authorities throughout the world have proved reluctant to confront those with immense wealth and power

The Pandora Papers revealed the inner workings of a shadow economy hiding wealth in tax havens such as Monaco (pictured), Panama, Dubai, Switzerland and the Cayman Islands. Photo from Shutterstock.

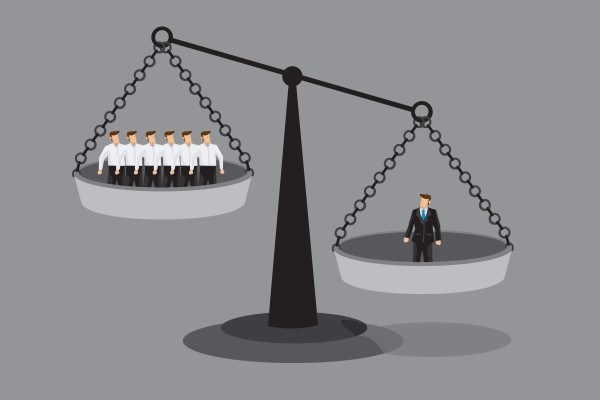

The Canadian chapter of the Pandora Papers, as the journalistic exposé of colossal asset concealment by the world’s rich and powerful has been dubbed, shouldn’t come as a surprise to anyone paying serious attention to tax issues and the enforcement practices of the Canadian Revenue Agency. The CRA’s response that they would look into it but that holding offshore wealth was not in itself illegal indicates the lack of enthusiasm to track down and tax the wealthy. It speaks to the Agency’s low-hanging fruit approach to tax enforcement. Much easier going after a waitress (or waiter) that you believe didn’t declare all her (or his) tips than someone who stashes their millions in the Cayman Islands (which oddly escaped the Pandora leaks) or the British Virgins. After all, that person is in a position to hire high-priced tax lawyers who can wheel and deal, bargain and barter and, in the unlikely event it came to it, tie the CRA up in expensive court litigation for years. This is just another way the social playing field is tilted to favour the one percent. According to the parliamentary budget officer, Canada loses $25 billion to tax shelters—that would fund a lot of social housing, intensive care units or green retrofit projects.

But the CRA is hardly alone. Tax authorities throughout the world have proved reluctant to confront those with wealth and power. In the United Kingdom, Revenue and Customs (HMRC) has been continuously criticized for having no clear strategy for tackling tax fraud by the wealthy. The dubious nature of the financial services industry with its various complex tricks and evasions makes it clear that we can never know for certain how much is protected from tax authorities, but the best guess of the International Consortium of Investigative Journalists (ICIJ) responsible for Pandora and the other leaks estimates that at least $11.3 trillion is held “offshore,” according to a 2020 study by the Paris-based Organization for Economic Cooperation and Development. While the Pandora Papers was a massive leak of details from disgusted whistleblowers inside the industry, it is not likely to put much of a dent in international tax evasion. But according to Brooke Harrington, author of Capital without Borders: Wealth Managers and the One Percent, there have been fewer than 10 convictions resulting from previous leaks.

Since there’s no sign of any Punishment Papers in the offing, we’re entitled to ask what the value is of leaks such as the Panama, Paradise and Pandora papers that reveal the dubious machinations of the rich and infamous? One consequence is the blaming and shaming of those in the public eye, and particularly in politics, who depend on their reputations to sustain their power at least to some degree. Many of the big names caught up in the recent leaks, such as the King of Jordan or Russian President Vladimir Putin (through his girlfriend) or Kenya’s supposed anti-corruption President Uhuru Kenyatta, are shielded to some extent from electoral sanction which does not affect monarchies and affects managed democracies only in a limited fashion. Politicians in retirement such as the UK’s Tony Blair and his wife saved a cool $434,000 in stamp duties on the purchase of an office in London by buying the offshore company that owned it. Former heads of state of El Salvador, Columbia, Peru and Panama have similarly escaped electoral consequences while feathering their nests. Others however, such as Andrej Babbis of the Czech Republic and Volodymyr Zelensky of the Ukraine, may be much more vulnerable. Both came to power riding that highly adaptable hobby horse of anti-corruption and may not be so easily forgiven their trespasses by voters, many of whom struggle to keep their kids fed and a roof over their heads. Back in 2016 the Prime Minister of Iceland Sigmundur David Gunnlaugsson was forced to step down after being named in the Panama Papers. Chile’s opposition has had President Sebastián Piñera in its crosshairs since the head of state’s name came out in the Pandora Papers. Both are market-friendly right-wingers.

Most of those who are named in the Pandora papers are business people who are not household names and are pretty much insulated from public pressure. Some are celebrities such as race car drivers (Jacques Villeneuve) or Olympians (Elvis Stojko)—Canadian examples who don’t seem to mind the company of pornographers such as Pornhub’s David Tassillo or convicted Italian mobster Raffaele Amato when it comes to creative tax planning. So there are obvious limits to name and shame. One other reason to celebrate the Pandora leaks is for their contribution to the negative publicity increasingly surrounding the world’s now 3,000 plus billionaires. They are, after all, the chief beneficiaries of the record levels of galloping inequality that Thomas Piketty and a slew of other economists have identified as a characteristic of this phase of capitalist development. The billionaires themselves have not been shy in further befouling their already tarnished image with their fixation on privatized space travel as the latest gimmick to mark the distance between them and us ordinary mortals. Amazon’s Jeff Bezos stands out here for his cloying expression of gratitude to Amazon workers for funding his blast-off. Then there is their attempt to dominate the social field with their much trumpeted philanthropic endeavours. Anand Giridharadas in his telling critique of billionaire charities (Winners Take All: The Elite Charade of Changing the World) concludes that the plutocrats are laundering their own reputations while at the same time avoiding taxes. He recently concluded that billionaire charity is “a relatively cheap, bargain-basement way of changing your name. You can do bad things in the billions and wipe it out with gifts in the millions.”

And notice that the names of Bezos, Gates, and Zuckerberg and co. don’t pop up in the 11.9 million files making up the Pandora leak. It is because they and their ilk do not rely on the more dubious financial services firms from whom these leaks flowed. They have their own Teflon systems and use their political clout to minimize their tax obligations and ensure that their tax rates remain unconscionably low. According to a Forbes report published in June, the 25 richest Americans paid a “true tax rate” of 3.4 percent on wealth growth of $401 billion between 2014 and 2018. Most other countries, including Canada, with an inheritance tax and generous capital gains provisions are similarly hospitable to billionaires.

Of course the hope lingers that the extensive leaks such as Pandora will force reform of the tax regime and reverse, or at least impede, the exacerbation of what is already a staggering level of global inequality. But it seems naïve to imagine that those who made the rules in favour of capital accumulation will now turn around and say “Gosh we never intended it to go this far.” After all, according to the 2020 version of the Financial Secrecy Index, the OECD countries and their dependencies together are responsible for about half of all financial secrecy risks. The UK-originated State of Tax Justice 2020 Report meanwhile assesses that the same group is responsible for 59 percent of the $182 billion the world loses to private offshore tax evasion every year. Dr. Dereje Alemayehu of the Global Alliance for Tax Justice summed up the concerns: “Trusting the OECD to set global [tax] rules… is like trusting a pack of wolves to build a fence around your chicken coop.” The US has now outstripped Switzerland as the leading financial secrecy threat with the state of South Dakota leading the way as the new home of opaque financial manoeuvrings. So it depends which shore you are talking about when you say offshore.

All that said, we can hope that Pandora and the other leaks may galvanize a global tax justice movement that will continue to try and build popular revulsion against wealth inequality and the system that underpins it. One possible reform could be an International Tax Organization (ITO) similar to the IMF and the WTO that could hunt down evaders and enforce sufficient tax provisions to actually tackle world poverty and ameliorate the climate crisis.

If not, the populist danger lurks that if the secret systems of globalization are not effectively challenged the far-right will be one of the chief political beneficiaries of the inequality crisis. For they are surely not wrong in claiming that the game is rigged—even if they have no intention of actually changing it.

Richard Swift is a freelance journalist and activist based in Montreal. He is a founding member of Between the Lines and worked for many years as an editor for the Oxford-based New Internationalist magazine. He is the author of a number of books including SOS: Alternatives to Capitalism.