Competition Bureau study on grocery chains strengthens case for windfall tax in Canada

Higher grocery chain markups have cost Canadians $18 billion since 2020

The Competition Bureau’s new study is just the latest in a string of evidence that corporate profiteering has cost Canadians gravely, writes D.T. Cochrane. Photo from Flickr.

A recent study by the Competition Bureau confirms that Canada’s grocery chains have reaped excess profit from food price inflation. The study points to a “modest, but significant” increase in the chains’ markups before the pandemic, which garnered each of the domestic chains—Loblaws, Empire and Metro—hundreds of millions or billions in excess profits.

The agency’s findings put wind in the sails of advocates calling for a windfall tax to deter corporate profiteering and return excess profits to public hands.

Grocery profiteering pre-dates the pandemic

The large corporate grocery retailers have downplayed profiteering from higher food prices. Executives from Loblaws, Empire, and Metro pointed to factors beyond their control—such as the war in Ukraine—for creating higher costs that they then passed down to consumers.

But the Competition Bureau study found grocery chains’ gross markup increased over the past five years, noting this “longer-term trend pre-dates the supply chain disruptions faced during the pandemic and the current inflationary period.”

A company’s gross markup is how much it adds onto its direct production costs. For example, if a corporation buys a pair of shoes for $100 and sells them for $110, the markup is 10 percent. If it sells the shoes for $150, the markup is 50 percent. The markup covers other costs, including things like marketing, executive bonuses, and interest payments. The Competition Bureau affirmed that gross markup is an important indicator of pricing power.

Because the grocery chains hiked their markups, when operating costs rose during the pandemic, gross profits increased. Returning to the shoes, if the input cost increased to $200, with a 50 percent markup, the company would sell them for $300. The cost doubled, and the company’s profit doubled. During the pandemic, if Loblaws, Metro, and Empire had applied their pre-2015 markups, Canadian consumers would have saved almost $18 billion.

Profiteering continued through the pandemic

The Competition Bureau emphasized the increase in gross markup before the pandemic. However, we can confirm that all three companies also increased markups during the pandemic, as seen below. By 2022, Loblaws’ markup had reached 47 percent, with Empire at 34 percent, and Metro at 25 percent. Loblaws and Metro raised their gross markups further in the first quarter of 2023.

The Competition Bureau emphasized that because grocery retail is high volume, even small increases in markup produce large increases in profit. The pandemic-era increases cost Canadians an extra $1.9 billion.

The calls are coming from inside the House

The latest endorsement to tax excess profits came from the government’s own committee studying food price inflation. In June, the Agriculture and Agri-Food committee released a report with more than a dozen recommendations on how Parliament should address rising food costs.

“If the Competition Bureau finds evidence in its upcoming market study that large grocery chains are generating excess profits on food items, the Government of Canada should consider introducing a windfall profits tax on large, price-setting corporations to disincentivize excess hikes in their profit margins for these items,” the committee report said.

The government must now seriously consider the committee’s recommendation to tax the excess profits of grocery chains.

The benefits of a windfall tax are two-fold: not only would it discourage companies from further hiking profit margins, revenue from the tax could be used to ease the pressure of inflation on Canadians. For instance, the government’s modest grocery rebate for low-income families could be expanded beyond the current income threshold to help more households.

Profiteering not exclusive to grocery sector

Much of the focus on inflation has centered around food prices, but the trend of corporations increasing profit margins at the cost of consumers has been consistent across all sectors of the economy.

Analysis by Canadians for Tax Fairness showed that in 2021, corporations reaped record profits, in part by increasing what they charge for their goods and services. Publicly-traded corporations nearly doubled profit margins to 16 percent in 2021, compared to the nine percent average for 2002 to 2019.

A windfall tax on all large profitable corporations could raise significant revenue for the government to invest in programs to make life more affordable, such as housing and pharmacare.

In 2021, the Parliamentary Budget Officer calculated that a proposal from the NDP to tax excess profits during the pandemic could generate nearly $8 billion in revenue from 2020.

Beyond tax reform: Other policy changes needed for Canada’s grocery sector

The Competition Bureau expressed concerns about increased consolidation in the grocery industry and how that affects the amount Canadians pay for food.

Today the market is dominated by the three large Canadian corporations, plus international chains such as Walmart and Costco. In 1986, there were at least eight large grocery chains in Canada, each owned by a different company. Since then, five of those eight chains have been bought by competitors.

“The fact that Canada’s largest grocers have generally been able to increase these margins—however modestly—is a sign that there is room for more competition in Canada’s grocery industry,” the report noted, adding “without changes in the competitive landscape, Canadians will not be able to fully benefit from competitive prices and product choices.”

Growing corporate concentration is not unique to the grocery sector. Mergers and acquisitions in Canada’s telecom industry have resulted in increased corporate power, but fewer choices for consumers. Canada’s oil and gas sector has also seen a rise in consolidation in recent years.

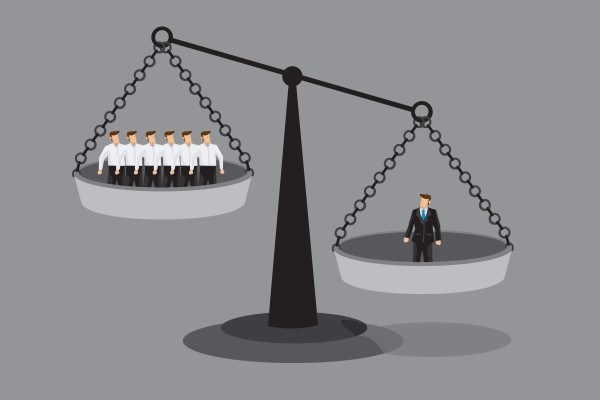

Larger corporations have greater pricing power. This not only hurts smaller and medium-sized businesses, but consumers as well.

The Bureau makes several recommendations to improve competition in the grocery sector such as encouraging more independent players and requiring stores to display unit pricing so shoppers can make informed decisions.

Both the Competition Bureau study and the House committee report highlighted the need for more transparency and cooperation from corporations. They also recommended legislative changes to give the Bureau greater powers to investigate companies.

The less discussed problem of corporate power and inequality

Inadequate regulation of Canada’s grocery sector—and the tax system’s failure to fairly redistribute corporate profits—has contributed to inequality.

Part of increasing profit margins involves pushing down costs, which comes at the expense of workers and smaller, less powerful businesses. As employees struggled with higher costs, corporations passed along gains to wealthy owners and shareholders.

A Globe and Mail study of more than 200 public companies found that as profits boomed between 2019 to the third quarter of 2022, the total dividends paid by companies soared by 24 percent. What’s more, the major grocery chains have paid out $2.8 billion in dividends over the last three years, plus $5.4 billion in share buybacks. This overwhelmingly benefits the wealthiest Canadians. In the case of Loblaws, about 25 percent of the money distributed to shareholders goes to the Weston family.

Corporations are also shelling out record amounts on executive compensation, with the average CEO now earning 243 times the average worker’s salary, according to the Canadian Centre for Policy Alternatives.

Low corporate tax rates, tax loopholes, and the absence of a windfall tax on corporations have made the rich even richer while robbing the Canadian public of tens of billions in lost revenue. A report by Canadians for Tax Fairness found that the largest corporations in the country avoided $30 billion in taxes in 2021.

The Competition Bureau’s study is just the latest in a string of evidence that corporate profiteering has cost Canadians gravely. The federal government has now been given a range of policy options to address the problem. A windfall tax on the largest and most profitable corporations would be an ideal place to start.

Dr. D.T. Cochrane is an economist and policy researcher with Canadians for Tax Fairness, a non-profit organization that advocates for fair and progressive taxes to reduce inequality and strengthen the economy.