Canada’s tax system should oppose inequality, not subsidize the rich

Imagine the investments we could have made by now if governments had approached taxes not as a problem, but as a solution

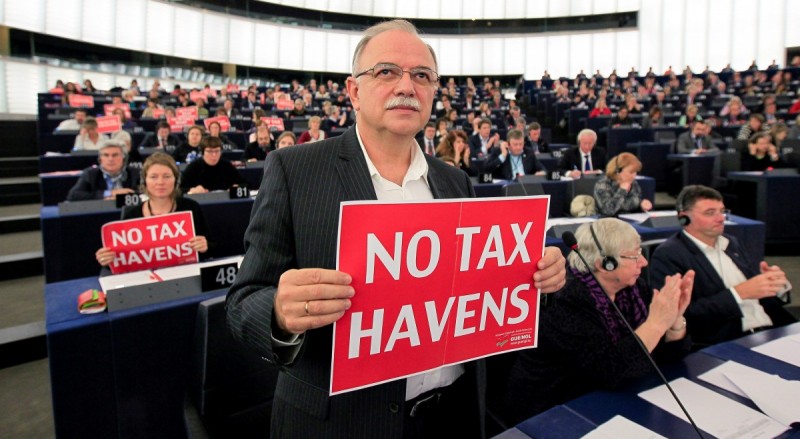

Members of the GUE/NGL protest tax havens in the European Parliament in 2014. Photo by GUE/NGL/Flickr.

Successive Canadian governments have treated taxes like a problem that can only be fixed through tax cuts, with more slashes promised from all sides during every election.

The result is a federal government with fewer revenues to spend on providing better services for its citizens. Government revenues as a share of the Canadian economy are now $50 billion lower than their long-term average.

Imagine the investments we could have made by now if governments had approached taxes not as a problem, but as a solution. Progressive tax policy has a significant role to play in addressing our country’s most pressing challenges, from the ongoing climate emergency to inequality’s seemingly unending expansion.

Even the head of the IMF, Kristalina Georgieva, recently called for higher tax rates on the highest incomes to address soaring inequality.

Though hardly known as a left-leaning global institution, the head of the IMF has acknowledged that extreme wealth is choking the global economy and increased spending on social programs is needed.

“Progressive taxation is a key component of effective fiscal policy,” she wrote.

Canadian politicians would be wise to heed her advice. Successive tax cuts carried out by our governments have been regressive. Not only have corporate tax rates been slashed in half since the 1990s, corporations and wealthy individuals today can choose from a growing array of tax loophole schemes that can help them avoid paying their fair share. As a result, incomes at the top one percent are taxed at an overall lower rate than all other income groups.

When businesses and the very rich pay less, the tax burden on middle- and low-income households increases. It also doesn’t help our economy, which thrives when most Canadians have more money to spend in their communities.

Corporations, on the other hand, are notorious for hoarding the excess cash that tax cuts allow them to get away with. As was highlighted in a recent report by Canadians for Tax Fairness, corporate tax cuts have failed to stimulate growth and investment, and have instead lead to excess, unspent cash for companies. Former Bank of Canada Governor Mark Carney referred to this as ‘dead money’ because it fails to do anything productive in the economy.

Experts in recent years have warned about the negative impacts of tax cuts that contribute to stark imbalances in corporate concentration and market power, ultimately eroding business competitiveness. Corporate tax cuts are the equivalent of government subsidies for the rich and have overwhelmingly benefited company shareholders through share buybacks, higher dividends, and exorbitant CEO pay.

A recent report by the Canadian Centre for Policy Alternatives found that corporate executive pay in Canada has reached new highs. CEOs pocket incomes that are 227 times larger than the average worker’s wages. Despite those new records, corporations today are paying even less in corporate income taxes than they pay their executives.

Increased investment in public services is a much better use of government spending, which does more to stabilize the economy and create good quality jobs. Progressive tax reform can bridge the wealth gap that regressive slash and burn tax policies have widened.

Sensible Canadian tax policy reforms could look like a cap on the amount that corporations can pay any single executive or employee, similar to a “maximum wage.”

In the US, Senator Bernie Sanders has proposed increasing the corporate tax rate on big companies, if their CEO pay is more than 50 times higher than the wages of the median worker.

A fairer tax system means citizens profit. Canada could recover billions of dollars in lost revenue just by increasing the tax rate on capital gains and closing regressive loopholes, such as stock option income tax deductions. Through these loopholes, the average worker pays more taxes on their hard-earned income than rich individuals pay for on their investment returns. Loopholes overwhelmingly benefit the richest 10 percent.

Governments in countries around the world lose an estimated $1 trillion USD to international corporate tax dodging and tax haven exploitation. Canada is no exception to this open corruption. In fact, many high-profile and influential Canadians are connected to tax havens; countries where foreign individuals or companies are subject to near-zero tax rates on money they dump in them. Large companies or wealthy individuals can hide profits from the main countries they operate in by registering fake shell companies in these jurisdictions where they then deposit their returns. New Brunswick’s Irving Group has links to tax haven schemes in Bermuda and former Prime Minister Paul Martin’s shipping company, Canada Steamship Lines, maintained a subsidiary in Barbados to hide profits under the country’s zero percent corporate tax rate regime.

Canadian corporations reported that they held over $350 billion worth of assets in the world’s top 12 tax havens at the end of 2018, while more than 90 percent of Canada’s largest 60 corporations, members of the TSX60, maintain subsidiaries registered in tax havens.

The Panama and Paradise Papers have revealed the scandalous misuse of tax havens and have raised public awareness and expectations of governments to do more to tackle corporate tax dodging. But despite some progress at the international level, current laws still allow multinationals to get away with cheating on their taxes most of the time.

Canada needs to implement tougher penalties for corporations and individuals who use tax havens to hide their profits, and to criminalize the tax professionals who help their clients set up these offshore schemes.

Increased funding for the Canada Revenue Agency would also help them investigate and prosecute these cases, which can be complex, secretive, and well-financed to defend against confiscation.

While it’s difficult to measure exactly how much revenue is lost to international tax dodging, the impacts can be seen throughout the economy. Digital corporate giants like Google, Apple, and Amazon are especially skilled at avoiding taxes in foreign jurisdictions.

These tax preferences have hurt Canadian companies and workers, especially in the media and cultural sectors where advertising revenues are siphoned by global giants like Facebook. Mainstreet businesses too are now competing with online retailers. Companies like Airbnb and Uber readily shelter their profits, while government investment in affordable housing and public transportation throughout Canada is strangled.

Removing the special tax treatment these companies receive would make the system fairer and generate additional revenues, but federal and provincial governments have yet to act.

Meanwhile, the OECD—another organization not known for leftist tendencies—is even discussing global tax rule reform, ensuring multinationals pay their fair share by treating them as one large company instead of multiple subsidiaries that make it easy for them to hide profits. There is also discussion among the OECD of setting a global minimum corporate tax rate that would eliminate zero percent tax rate jurisdictions.

Another proposed global reform would allocate corporate profits across jurisdictions, a system of equalization like the one Canada already uses between provinces. Considering this allocation system has worked well in our country for over half a century, Canada could take a leadership role in building a new global tax regime instead of sitting on the sidelines as we currently do.

We can fund a better life for every Canadian by ending our fixation on tax cuts. Canada can build a national pharmacare program, ramp up the fight against climate change, provide affordable housing and childcare, and make other investments for an equitable society if we act for a fairer tax system.

Canadians for Tax Fairness is a non-profit organization that advocates for fair and progressive tax policies aimed at building a strong and sustainable economy, reducing inequalities and funding quality public services.