Budget 2024 is a small step toward a grown-up economy

For too long, we’ve been experimenting with governments trying to leave economic progress to free market forces

Photo by Ken Teegardin/Flickr

The latest federal budget has provoked outrage among some of the wealthiest people in the country. They regard a change to the way we tax capital gains as an attack on their excessive, unearned wealth and the power it confers.

To defend their concentrated control over our economy, mouthpieces for the ultra-wealthy are repeating many standard narratives about government spending, taxation, investment, productivity, and well-being. These narratives, although disconnected from reality, are powerful. They must be confronted because they undermine our ability to deal with the many serious issues that we actually face.

Is the federal government’s spending too much?

Since the release of Budget 2024, we have repeatedly heard the refrain that federal spending is out of control, and that this threatens Canada’s economic prosperity. Nothing could be further from the truth.

Current and projected federal spending is well within the norms of recent decades. Given our aging population, the increase in health care costs, along with the other crises we face, from climate change to global instability and conflict, federal spending is actually too low.

Since 2007, Canadian governments of all levels spent over $7,000 less per person per year, than the United States. This is part of the reason why the US economy is significantly outperforming Canada’s. Claims that the federal government is being fiscally irresponsible by overspending are completely upside-down. The irresponsibility is government underspending.

Federal red ink is black ink for the rest of the economy

When the federal government spends it does more than support a policy goal, it creates financial assets for the rest of the economy.

Whether paying salaries, buying goods and services, or making transfers, the federal government spends money into the economy. The recipients will spend some of that money on goods and services from businesses. Those businesses can use a portion of the income to pay suppliers and workers. The remainder could be invested into new productive assets or distributed to owners as dividends.

The financial assets created by government spending facilitate subsequent economic activity and remain within the economy until taxed back by the government. Those who claim the federal debt is a burden on the future are, at best, misinformed. At worst, this is deliberate disinformation intended to undermine public funding.

Increasing capital gains taxation is long overdue

Although the federal government does not need tax revenue to spend, taxes return money to public hands, reducing inflationary pressure, as well as the harmful power imbalance from inequitable wealth distribution. Taxes should draw money out of the economy in a way that is fair and equitable.

The government has done the right thing by increasing the inclusion rate on capital gains, even if the increase is narrowly targeted at the ultra-wealthy. The expected revenue will cover a significant portion of the projected spending increase.

Currently, only half of capital gains are subject to taxation. The other half is completely tax-free. It is the only major source of income that gets this preferential treatment.

The government will now tax two-thirds of all capital gains for corporations and trusts, and gains over $250,000 per year for individuals. The government also increased and added some generous exemptions. As planned, only individuals receiving the highest 0.13 percent of incomes will pay any additional tax.

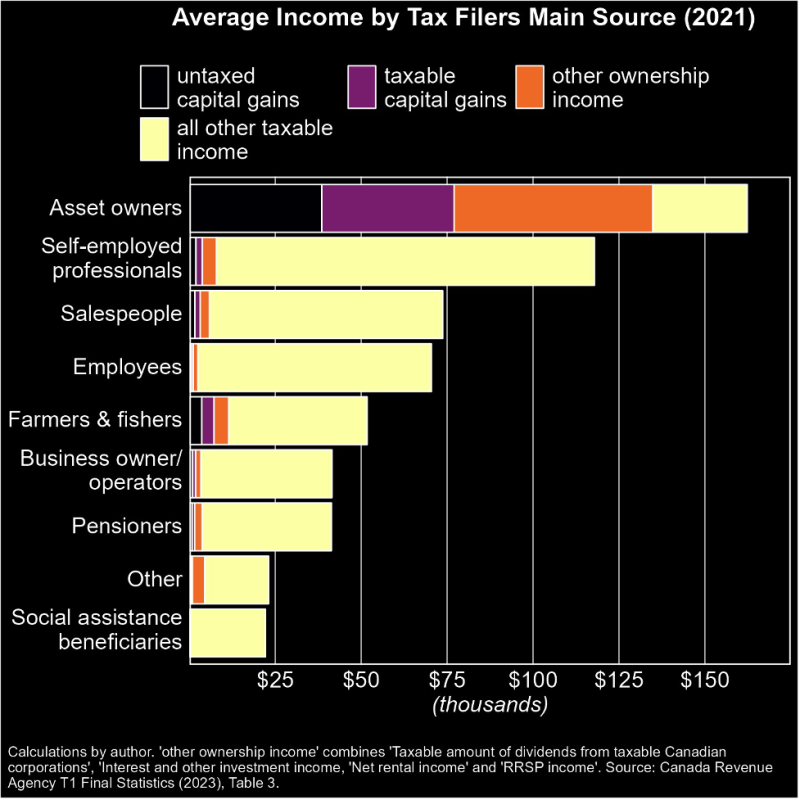

Predictably, opponents of the change are trotting out the claim that this is an attack on small businesses and retirees. However, a large majority of capital gains go to people whose income is primarily from owning stuff. In other words, as the term ‘capital gains’ gives away, capitalists collect most of this form of income.

In 2021, the average capital gains for those who own instead of working were greater than the average total income of everyone else: $77,040 versus $54,658. Because half of those gains were tax-free, this group had a lower effective income tax rate than people whose income is derived primarily from being an employee or operating a business. This undermines the progressivity of our income tax system.

Another talking point against this tax increase is that eventually it will hit the average person who inevitably collects a windfall gain from investing. However, research shows that over a 10-year period, 81 percent of tax filers claim no taxable capital gains. The average gains among those who claimed at least one year was just $516. Even among tax filers who reported gains in all ten years, the average was less than $1,100 annually.

What about investment and productivity?

The biggest myth being peddled about the increase to capital gains taxes is that it will undermine investment and further erode Canada’s productivity. We’ve been told a version of this tale for decades. It was the justification for cutting the inclusion rate in 2000, from 75 percent where it had been set by the Mulroney government in 1990.

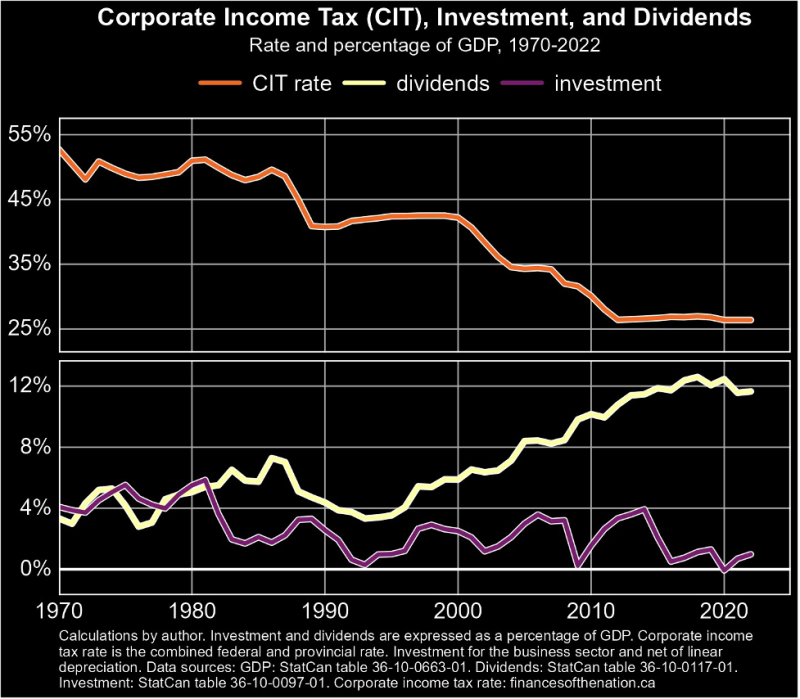

Increased investment was also the justification for cutting corporate income taxes (CIT) throughout the 2000s and 2010s. But net investment remained anemic, well below levels from the 1970s when the combined federal-provincial CIT was almost double its current level. Instead, dividends steadily increased and are now three times higher than in the early-1990s.

The idea behind cutting taxes on the rich to increase investment is also known as “trickle down economics”—a debunked and rightly reviled theory. It assumes that the wealthy, in pursuit of ever greater returns, will allocate capital where it is most effective. There is an implicit assumption that the most profitable investments will be the best for society. A related argument claims that the ultra-wealthy are risk-takers and increasing capital gains taxation will dampen their socially-beneficial risk-taking.

However, there is no reason to accept the equation of the ultra-wealthy’s high-risk, high-return investments with our economic interests. Consider some of what we’ve gotten from prioritizing the profit-driven investment decisions of capitalists: an over-developed fossil fuel sector and some of the world’s highest per capita emissions, bloated finance and real estate sectors and a lack of affordable housing, increased market concentration and corporate pricing power, underinvestment in health care, child care, long-term care, and environmental care.

Some question the wisdom of increasing taxes on capital gains when Canada is dealing with weakening productivity. Setting aside the vital question—“production of what”—there is no more evidence for the suggestion that higher taxes will worsen productivity than for the claim that lower taxes will increase investment.

In fact, OECD countries that tax capital gains at higher rates are associated with higher levels of output.

Let’s grow up about the need for economic management

For decades, we’ve been experimenting with governments trying to leave economic progress to free market forces. From many perspectives, not least inequality and ecological degradation, the result has been disastrous. This is not because free market forces failed to deliver. Rather, it is because the very idea is nonsensical.

The political economist Karl Polanyi detailed in his masterpiece The Great Transformation that markets do not—and cannot—exist without governance. By trying to limit the public sector’s economic role as much as possible, we ended up with too much uncoordinated, conflicting, and ineffectual government action, on the one hand. On the other hand, we abdicated economic governance to the C-suites, where corporate executives make decisions in the interest of owners rather than the public.

The solution is not to maintain this outmoded insistence that the problem is government interference. Instead, we need to take collective responsibility for the difficult work of creating the kind of just, sustainable economy that we deserve. The way we do so is through our public institutions. Despite their many shortcomings, they are orders of magnitude more accountable and more transparent than corporations. Of course it is hard work. Yes, things will go wrong. But there is no magic solution if only we “leave it to the market.” C.D. Howe, Canada’s legendary former minister of trade and commerce, didn’t shirk from the difficulty of managing Canada’s economy through the Second World War. Neither should we.

The 2024 budget does not get us anywhere near the kind of public leadership that we need. But the increase to capital gains taxes is an important, if minor, reversal of tax cuts that increased the wealth and power of the richest families at the expense of everyone else. That increase needs to be defended against the vested interests that will refuse any challenge to their power.

D.T. Cochrane is senior economist with the Canadian Labour Congress, Canada’s largest labour organization.