-

Is China headed for a crash?

So, is this the moment of collapse in the Chinese model of development and the end of all that talk about ‘moving towards socialism’ and so on? Many Western experts think so. What will cause this collapse, in their view, is the failure of the Chinese leaders to ‘liberalize’ the economy and open it up even more to capitalist companies and markets.

-

A tightening world

The world of credit is tightening and bringing with it a downturn in financial asset prices, but also exposing the fault lines in ‘real economy’ production, writes Marxist economist and author Michael Roberts. As the Financial Times put it in an editorial published last week: “the choice is stagflation, or deflationary depression.”

-

Australia: Turning for the worse?

The Chinese economy has slowed down, and with it the demand for Australia’s exports. Anyway, the imperialist bloc wants Australia to disengage from China. The cost of living is rising sharply; rising interest rates risk a serious housing crisis; and global warming is out of control. Neither government nor opposition have any answers. Australia’s luck is turning for the worse.

-

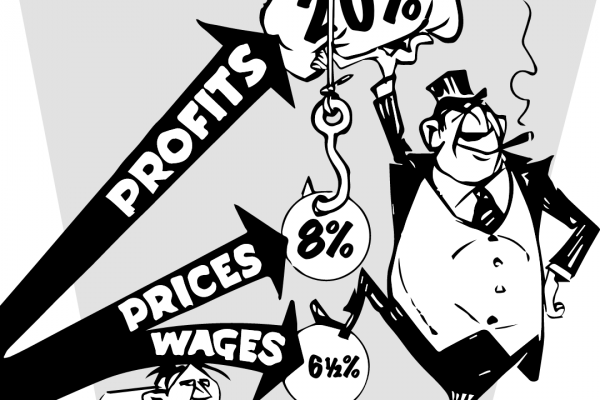

Inflation: Wages versus profits

Chief executives are acutely aware to the ability to hike prices in this inflationary spiral. Hershey CEO Michel Buck told shareholders, “Pricing will be an important lever for us this year and is expected to drive most of our growth.” Similarly, a Kroger executive told investors “a little bit of inflation is always good for our business,” while Hostess’s CEO in March said rising prices across the economy “helps” profits.

-

The great inflation debate rages on

The inflation debate among mainstream economists rages on. Is the accelerating and high inflation rate of commodities here to stay for some time and or is it ‘transitory’ and will soon subside? Do central banks need to act fast and firmly to ‘tighten’ monetary policy by cutting back purchases of government bonds and hiking interest rates sharply? Or is such tightening an overkill and will cause a slump?

-

The end of dollar dominance?

The shift in international currency strength after the Ukraine war will not form into some West-East bloc, as most argue, but instead towards a fragmentation of currency reserves, argues economist Michael Roberts. To quote the IMF: “if dollar dominance comes to an end (a scenario, not a prediction), then the greenback could be felled not by the dollar’s main rivals but by a broad group of alternative currencies.”

-

Korea: From Moon to Yoon

New South Korean President Yoon Suk-yeol’s economic program is classically neoliberal. He supports ‘market-led approaches,’ including job creation led by the private sector rather than government projects. But these policies are unlikely to stem the tide of the country’s rising poverty rate and its income inequality, which are among the worst among wealthy countries, with youths facing some of the steepest challenges.

-

Russia: From sanctions to slump?

Putin’s invasion of Ukraine is going to be costly for Russia and its people. Oxford Economics reckons it will knock at least one percentage point a year off Russia’s real GDP growth over the next few years. If that happens, the country will be in economic recession for several years. Whatever the case, once the war is over, Ukraine’s people will see little of the benefit.

-

Views on China

What is the experience and future for China and its Communist Party rule? It seems appropriate to consider a number of new books on China that have been published that try to answer this question. In this review, Michael Roberts takes a closer look at Isabella Weber’s How China Escaped Shock Therapy, John Ross’s China’s Great Road, and China’s Engine of Environmental Collapse by System Change Not Climate Change co-founder Richard Smith.

-

COVID vaccines: Calling the shots

What better lesson can we learn from the COVID vaccine experience than that the multinational pharma companies should be publicly owned so that research and development can be directed to meet the health and medical needs of people rather than to the profits of these companies. Then the necessary vaccines can get to the billions in the poorest countries and circumstances rather than to just the wealthiest.